Sometimes I feel like I learn more from my eight-year-old daughter, Alina, than she learns from me. Any parent reading this probably knows exactly what I mean; it’s humbling how much wisdom children have.

Last month, Alina was making a necklace for a friend. She carefully chose each bead and created what she thought was the perfect pattern. But halfway through, she realized she’d missed a few key beads. Devastated, she started to cry. I tried to reassure her by saying, “It’s okay. The necklace still looks beautiful.”

But Alina wasn’t convinced. To her, the specific pattern and carefully chosen colors were what made the necklace special. So we took it apart and started again, focusing on each bead, making sure every decision counted.

As I reflected, I couldn’t help but think of investing. (Clearly, I need to work on turning off my finance brain once in a while.) Especially these days, with the escalating crisis in the Middle East and Asia, central banking decisions and the looming U.S. election, it’s hard not to get distracted by external events. Many investors, either by choice or due to the sheer gravitational pull of shifting economic forces, focus on trying to predict where the market will go tomorrow instead of understanding the underlying components.

At Oakmark, we focus our attention on fundamental details: individual management teams, company cash flows, and the returns on their projects, for example. We believe that these fundamentals generate consistent, significant value growth and by making careful, deliberate decisions based on fundamentals, we can create something meaningful and distinctive. Like Alina’s necklace, it’s the attention to each individual piece that ultimately creates the value in the whole.

Our team focuses on three key details that drive value:

- Management: We invest in companies with strong, proven leaders who act like owners. These management teams consistently make shareholder-aligned decisions across market cycles, through good and bad times.

- Fundamentals: We analyze companies’ cash flow, balance sheets and business models to ensure they are built for long-term success, regardless of short-term market fluctuations.

- Buying at a Discount: Our strategy centers on purchasing securities at a discount to their intrinsic value, ensuring we build in a margin of safety.

Good management is cyclically resistant

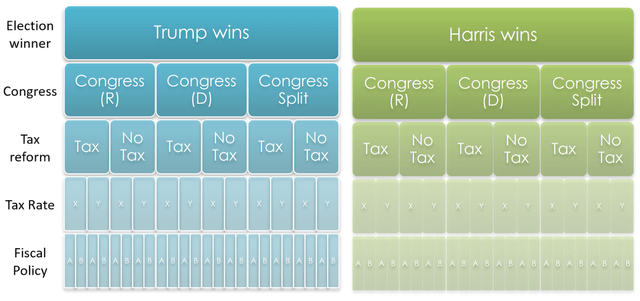

As the election nears, many investors focus on what the results might mean for tax policy, foreign relations or corporate earnings. It’s natural to wonder how political outcomes will shape the market, but trying to predict how various results will impact long-term business value is mostly a guessing game. Even now, only a month from election day, look at the multiple possibilities just in the simplified model below. Imagine if we miraculously guessed the right probabilities at each branch. We would still have to determine how these outcomes would ultimately impact the earnings and valuations for each of our investments-an extreme challenge.

Chart 1: Even a simplified model indicates many possible outcomes

Impacts on valuation can be almost impossible to predict

We don’t try to predict political outcomes. Instead, we focus on the key components that will have direct, day-to-day impact on our investments. Rather than attempting to predict who will become manager of the free world, we assess the managers who lead the companies we invest in. Unlike political leaders who change every few years, strong management teams can deliver consistent results driven by long-term strategic vision.

ChampionX’s (formerly known as Apergy Corporation) management team is a great example. Its leadership team stayed focused on the long view, making key decisions aligned with stakeholder interests at multiple points in the past five years, despite volatile conditions in energy end markets.

In late December 2019, with oil prices less than $60 per barrel and decreased activity from its exploration and production clients, Apergy management decided to acquire Ecolab’s upstream energy business, seizing a fantastic opportunity during a soft period in the cycle.

The deal:

- Enhanced Apergy’s geographic diversification

- Expanded its customer base

- More than doubled the company’s revenue and EBITDA

- Improved its cash flow generation while rounding out its product suite

- Made the company an essential supplier to its customers

Management also easily exceeded its original $75 million synergy target all while maintaining modest leverage and doubling its market cap. Then, near the top of the most recent oil and gas cycle, management crystalized the company’s value by agreeing to sell to SLB in an all-stock deal at a 15% premium or a 10.2x (FY2024) EV/EBITDA multiple in April 2024.

This kind of steady leadership through diverse and dynamic conditions is what we seek. By investing in companies led by proven, long-term-focused management teams, we reduce our exposure to the unpredictability of politics, as well as the unpredictability of macroeconomic conditions. With the right leadership in place, short-term market noise becomes far less relevant.

Fundamentals drive value

While evaluating the management team is crucial, it is just as essential to understand the fundamentals of a business. More and more I hear or read someone make sweeping claims that credit is “rich” or “tight” and insinuate that it’s time to sell. There’s certainly no debate that credit spreads are at the top quartiles of historical averages. Anyone with access to historical data can quickly verify that claim. But at Oakmark, price in a vacuum does not determine an investment’s value; instead, company fundamentals determine our assessment of a fair investment price.

At the index level, there has been a slight deterioration in metrics, which one would expect at the beginning of a rate cutting cycle, but interest coverage and net leverage continue to point to a very healthy environment for most underlying high yield and investment grade index constituents. Meanwhile, capex cycles are slowing and free cash flow generation is stable.

But index level observations aren’t where we spend most of our time gaining conviction. There’s still plenty of dispersion in the market.

Some companies may be overvalued while others are undervalued or misunderstood. By digging into individual businesses, we uncover opportunities that many overlook. Rather than relying on macroeconomic predictions, we focus on mid-cycle earnings over the next three to five years.

Fundamentals drive long-term value, no matter how the broader market behaves. It’s like looking at the pieces of a puzzle or the beads of a necklace and slowly telescoping out: Each fundamental detail eventually reveals the bigger picture.

Risk management beyond volatility

Risk management should always be on investors’ minds, but the definition of risk management is just as, if not more, important than the act of implementation itself. For example, the crisis in the Middle East and other geopolitical risks are certainly on investors’ minds. The timing and magnitude of the Fed’s future rate cuts also affect investors’ decisions. How do you protect against such wide-ranging, unpredictable outcomes? Our answer is simple: buying securities at a discount to their intrinsic value.

Many believe that the best way to reduce risk is to neutralize their position weights and mimic the benchmarks. But these moves can increase risk. Allocating capital based on benchmarks ignores the fundamental value of the securities.

We don’t view risk management as simply minimizing volatility. Instead, we focus on buying securities with a margin of safety-paying less than what we believe they’re worth. It’s like building a foundation that’s strong enough to withstand any storm. We find this approach offers real protection in the long run, no matter how the market moves in the short term.

By concentrating on fundamentals and maintaining a margin of safety, we seek to manage risk effectively, avoiding the pitfalls of chasing lower volatility or reacting to market sentiment.

Conclusion

At Oakmark, we believe true value is built detail by detail. It’s easy to get distracted by the noise of macroeconomic debates, political shifts or market trends. But like with Alina’s necklace, the deliberate decisions matter the most. By focusing on the right companies, the right management teams and the right fundamentals, we build sustainable, meaningful value. As investors, it’s the attention to these details that sets us apart and enables us to create value, one bead-or one investment-at a time.

Adam D. Abbas, Portfolio Manager

|

The securities mentioned above comprise the following percentages of the Oakmark Equity and Income Fund’s total net assets as of 09/30/2024: ChampionX Term Loan B 7.695% Due 06-07-29 0.2%. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks. The securities mentioned above comprise the following percentages of the Oakmark Bond Fund’s total net assets as of 09/30/2024: ChampionX Term Loan B 7.695% Due 06-07-29 0.5%. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks. To obtain a full list of the most recent quarter-end holdings, please visit our website at www.oakmark.com or call 1-800-OAKMARK (625-6275). The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. Certain comments herein are based on current expectations and are considered “forward-looking statements.” These forward-looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements. Yield is the annual rate of return of an investment paid in dividends or interest, expressed as a percentage. A snapshot of a fund’s interest and dividend income, yield is expressed as a percentage of a fund’s net asset value, is based on income earned over a certain time period and is annualized, or projected, for the coming year. Maturity is the weighted average of the stated time to maturity for the securities held in the portfolio. EBITDA refers to Earnings Before the deduction of payments for Interest, Taxes, Depreciation and Amortization which is a measure of operating income. The EV/EBITDA ratio is a comparison of Enterprise Value and Earnings Before the deduction of payments for Interest, Taxes, Depreciation and Amortization which is a measure of operating income. The Oakmark Bond Fund invests primarily in a diversified portfolio of bonds and other fixed-income securities. These include, but are not limited to, investment grade corporate bonds; U.S. or non-U.S.-government and government-related obligations (such as, U.S. Treasury securities); below investment-grade corporate bonds; agency mortgage backed-securities; commercial mortgage- and asset-backed securities; senior loans (such as, leveraged loans, bank loans, covenant lite loans, and/or floating rate loans); assignments; restricted securities (e.g., Rule 144A securities); and other fixed and floating rate instruments. The Fund may invest up to 20% of its assets in equity securities, such as common stocks and preferred stocks. The Fund may also hold cash or short-term debt securities from time to time and for temporary defensive purposes. Under normal market conditions, the Fund invests at least 25% of its assets in investment-grade fixed-income securities and may invest up to 35% of its assets in below investment-grade fixed-income securities (commonly known as “high-yield” or “junk bonds”). Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. All information provided is as of 09/30/2024 unless otherwise specified. Before investing in any Oakmark Fund, you should carefully consider the Fund’s investment objectives, risks, management fees and other expenses. This and other important information is contained in a Fund’s prospectus and summary prospectus. Please read the prospectus and summary prospectus carefully before investing. For more information, please visit Oakmark.com or call 1-800-OAKMARK (1-800-625-6275). Harris Associates Securities L.P., Distributor, Member FINRA. Date of first use: 10/07/2024 QCM-4024ADA-01/25 |

Original Post

Read the full article here